Protecting Your Wealth: Why You Need an Offshore Trustee for Asset Preservation

Protecting Your Wealth: Why You Need an Offshore Trustee for Asset Preservation

Blog Article

Comprehending the Role of an Offshore Trustee: What You Need to Know

The function of an overseas trustee is typically misunderstood, yet it plays an essential part in securing and taking care of possessions throughout borders. The ins and outs involved in choosing the right trustee and the prospective consequences of that option warrant mindful factor to consider.

What Is an Offshore Trustee?

An overseas trustee is a specific fiduciary who provides counts on established in territories outside the individual's country of residence. This duty usually arises from the need for asset security, tax obligation effectiveness, or improved personal privacy. Offshore trustees are typically employed by individuals looking for to manage their wide range in a manner that follows worldwide laws while enhancing advantages paid for by details jurisdictions.

The selection of an offshore trustee is crucial, as it involves leaving them with significant financial properties and the authority to choose concerning the management and distribution of those possessions. Offshore trustees may be organizations or individuals, such as banks or trust companies, and they have to have a deep understanding of worldwide law, tax obligation guidelines, and the specific terms of the depend on agreement.

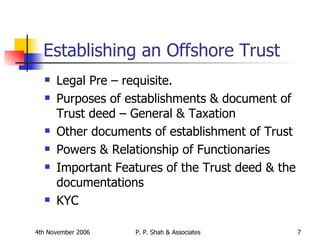

Moreover, the territories in which these trustees run often have beneficial lawful structures that promote reliable trust management, offering a layer of protection and security for the settlor's properties. It is important for individuals taking into consideration an overseas count on to engage with competent lawful and financial experts to make certain that their option of trustee aligns with their objectives and adhere to the pertinent laws.

Secret Duties of Offshore Trustees

Offshore trustees carry a series of vital responsibilities that are important to the efficient monitoring of depends on. One of their primary responsibilities is to ensure compliance with the appropriate laws and guidelines of the overseas jurisdiction, which calls for a detailed understanding of both regional and international legal structures - offshore trustee. This aids safeguard the count on's properties and makes certain appropriate tax therapy

Another vital obligation is the exact record-keeping and monetary coverage. Offshore trustees must keep in-depth accounts of all transactions and offer beneficiaries with transparent records, making sure that the beneficiaries are informed concerning the depend on's performance.

Furthermore, trustees have to maintain fiduciary tasks, acting in good confidence and prioritizing the interests of the recipients above their very own. This includes making equitable and reasonable choices concerning circulations and handling conflicts of interest. On the whole, an offshore trustee's role is essential in securing the count on's stability and ensuring its lasting success.

Advantages of Making Use Of an Offshore Trustee

Making use of an offshore trustee supplies many advantages that can improve the management and security of trust fund possessions. Among the primary advantages is asset security. Offshore territories commonly provide durable legal frameworks that guard assets from lenders, legal actions, and political instability in the grantor's home country. This added layer of safety is specifically appealing for high-net-worth individuals seeking click here to find out more to maintain their wealth for future generations.

Furthermore, overseas trustees commonly possess specialized know-how in global money and tax obligation law, enabling them to optimize the count on's financial structure. This competence can cause positive tax obligation preparation possibilities, as particular jurisdictions may use tax rewards that can improve the total worth of the trust fund.

Confidentiality is another considerable advantage; numerous overseas jurisdictions promote stringent personal privacy legislations that shield the information of the count on and its beneficiaries from public analysis. This discretion can be crucial for individuals aiming to keep discernment regarding their financial affairs.

Furthermore, overseas trustees provide a degree of specialist management that can guarantee adherence to legal needs and ideal methods. By delegating these responsibilities to seasoned experts, trustors can concentrate on other elements of their financial planning while taking pleasure in peace of mind concerning their depend on assets.

When Choosing a Trustee,## Aspects to Consider.

Picking the best trustee is an important decision that can dramatically affect the effectiveness and long life of a depend on. Several aspects ought to be considered to ensure that the trustee straightens with the depend on's recipients and objectives' demands.

To start with, review the trustee's experience and expertise in taking care of counts on. An ideal trustee needs to possess a solid understanding of count on law, investment approaches, and monetary monitoring. This competence ensures that the trust fund's possessions are taken care of effectively and in accordance with the settlor's desires.

Second of all, consider the trustee's track record and reliability. Carrying out complete research right into the trustee's history, including recommendations and evaluations from previous customers, can supply insights into their trustworthiness and expert conduct.

Furthermore, evaluate the trustee's communication abilities and accessibility. A trustee needs to be able to plainly articulate trust-related issues to recipients and be obtainable for updates and discussions.

Lawful and Tax Obligation Ramifications

Browsing the lawful and tax ramifications of appointing an overseas trustee is important for ensuring compliance and making best use of the benefits of the trust fund framework. The selection of jurisdiction plays a critical go to website duty in figuring out the lawful structure governing the count on. Different jurisdictions have differing laws concerning possession security, personal privacy, and the legal rights of recipients, which can significantly impact the efficacy of the trust.

Beneficiaries might be subject to taxes in their home nation on circulations received from the overseas count on. In addition, particular jurisdictions enforce taxes on the trust itself, which can deteriorate its overall value.

Furthermore, conformity with coverage demands, such as the Foreign Account Tax Compliance Act (FATCA) for united state citizens, is necessary to prevent penalties. Involving with tax experts and legal consultants who concentrate on overseas structures can offer important insights and make certain the depend on is established and kept abreast with all appropriate laws and guidelines. By very carefully taking into consideration these ramifications, individuals can shield their possessions while maximizing their tax placements.

Final Thought

In verdict, the role of an offshore trustee is vital for effective asset administration and defense. By acting as a fiduciary, offshore trustees guarantee conformity with international regulations, prioritize recipients' rate of interests, and supply specialized proficiency in economic and tax obligation matters.

An offshore trustee is a specialized fiduciary that provides trusts established in jurisdictions outside the person's country of house.Offshore trustees carry a variety of vital duties that are essential to the effective monitoring of depends on. In general, an offshore trustee's function is vital in guarding the depend on's stability and ensuring its long-term success.

Utilizing an offshore trustee supplies countless benefits that can improve the administration and protection of trust properties.Browsing the legal and tax obligation implications of selecting an offshore trustee is important for guaranteeing compliance and maximizing link the advantages of the trust fund framework.

Report this page